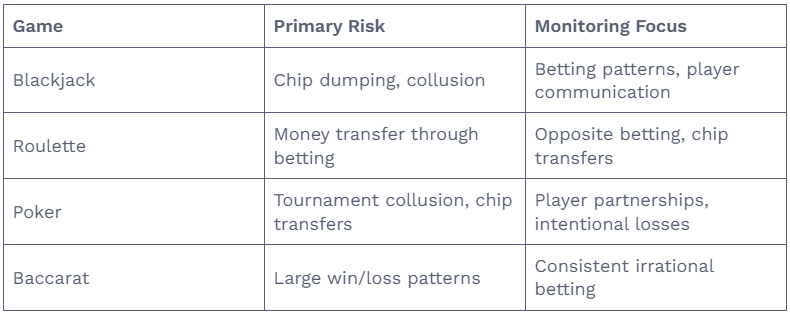

1. Game-Specific Money Laundering Risks

Table Game Vulnerabilities

Slot Machine Considerations

- Minimal play before large cashout

- Multiple machines used by same player

- Coordination between players on adjacent machines

2. Behavioural Monitoring on Casino Floor

Suspicious Behaviour Indicators

- Avoidance Behaviour: Staying away from surveillance areas

- Communication Patterns: Signals between players

- Playing Patterns: Intentional losses, irrational bets

- Chip Movement: Unexplained transfers between players

Documentation Requirements

- Incident Reports: Detailed descriptions of suspicious behaviour

- 5W1H Method: Who, What, When, Where, Why, How

- Evidence Preservation: CCTV timestamps, witness statements

3. Chip Transaction Controls

Chip Dumping Identification

Definition: Intentional loss of chips to another player to transfer value

Detection Methods

- Monitoring bet patterns against basic strategy

- Tracking chip movement between associated players

- Analyzing win/loss ratios for abnormalities

Chip Walking Prevention

- Supervision of chip transfers between tables

- Documentation of large chip movements

- Verification of play before large cashouts

4. Collusion and Chip Dumping Detection

Common Collusion Techniques

- Signal Systems: Hand signals, betting patterns as communication

- Soft Play: Intentional weak play against accomplices

- Chip Passing: Physical transfer of chips between collaborators

- Information Sharing: Sharing knowledge of hidden cards

Prevention Measures

- Regular dealer training on detection techniques

- Surveillance coordination for suspect tables

- Player behaviour analysis software

- Table rotation policies for staff

5. Progressive Jackpot Compliance

Large Win Protocol

- Immediate Verification: Confirm win legitimacy

- Customer Identification: Full CDD regardless of amount

- Source of Funds: Verify funds used to play

- Enhanced Documentation: Complete win package

- STR Consideration: Assess for suspicious circumstances

Tax and Reporting Requirements

- Withholding tax calculations per Sri Lankan law

- CTR filing for cash payments above LKR 10M

- International winner reporting for foreign nationals

- Coordination with Accounts department for payment processing

6. Gaming Red Flag Dictionary

Blackjack-Specific Indicators

“Intentional Busting”

- Definition: Player deliberately exceeds 21 when holding strong position

- Detection: Player hits on 18-20 against dealer’s weak card

- Why It Matters: Method to lose chips to accomplish partner

- Action: Document pattern, notify surveillance, prepare STR

“Maximum Bet Losses”

- Definition: Placing maximum bets then making worst possible decisions

- Detection: Consistent play against basic strategy

- Why It Matters: Rapid fund transfer disguised as gambling

- Action: Monitor for receiving party, file STR

Roulette-Specific Indicators

“Opposite Outcome Betting”

- Definition: Two players betting opposing outcomes (red/black, odd/even)

- Detection: Coordinated betting through accomplices

- Why It Matters: Covers the board to guarantee one win, transfers value

- Action: Identify both players, link transactions, STR filing

Poker Tournament Red Flags

“Soft Play Collusion”

- Definition: Player intentionally folds strong hands to eliminate competitors

- Detection: Irrational folding patterns, communication signals

- Why It Matters: Manipulates tournament to benefit accomplice

- Action: Review hand history, tournament disqualification, STR

Leave a Reply