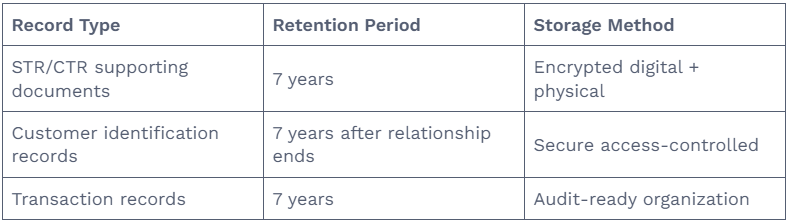

1. Financial Record Keeping Requirements

Document Retention Schedule

- Financial statements | Permanent | Primary and backup locations |

Audit Trail Standards

- Immutable record of all financial movements

- User identification for each system entry

- Timestamp accuracy with system synchronization

- Regular integrity verification checks

2.CTR and STR Documentation

CTR Preparation Checklist

- Customer identification verification

- Transaction amount and currency confirmation

- Date and time accuracy

- Aggregation calculations for multiple transactions

- Principal Officer review and approval

- FIU submission confirmation

STR Supporting Evidence

- Customer profile and history

- Transaction details and patterns

- Documentation of suspicious behaviour

- Investigation notes and rationale

- Supporting documents (IDs, bank statements, etc.)

3. Audit Trail Maintenance

System Integrity Controls

- Access Logs: Who accessed what and when

- Change Records: Modification history with reasons

- Approval Workflows: Electronic sign-off requirements

- Backup Systems: Regular tested backups

Data Protection Measures

- Encryption standards for stored data

- Access controls based on job responsibilities

- Regular security vulnerability assessments

- Incident response plan for data breaches

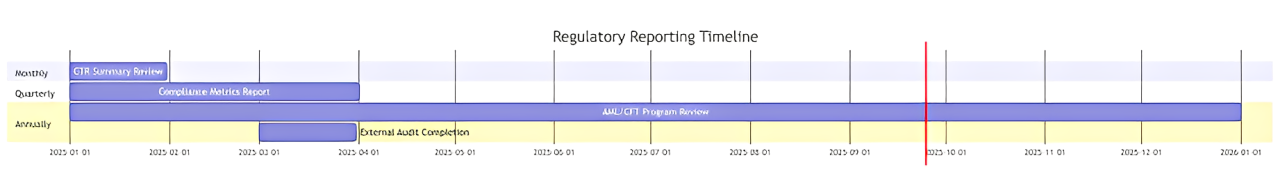

4. Regulatory Reporting Compliance

FIU Reporting Timeline

Report Quality Standards

- Accuracy and completeness verification

- Timeliness of submission

- Consistency with internal records

- Readability and professional presentation

5. Budgeting for Compliance Resources

Compliance Cost Allocation

- Technology systems and maintenance

- Staff training and certification

- External audit and consulting fees

- Regulatory fines and penalty reserves

- Continuous improvement initiatives

ROI Measurement

- Reduction in compliance incidents

- Audit finding improvements

- Regulatory examination results

- Staff competency assessment scores

Leave a Reply