1. Cash Handling Compliance Protocols

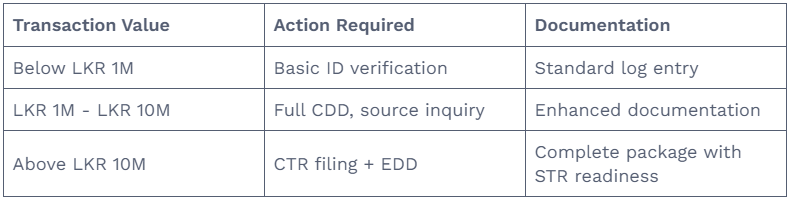

Transaction Thresholds and Actions

Dual Control Principle

- All transactions above LKR 5M require two authorized signatories

- Cash counts must be verified by supervisor

- System overrides require Principal Officer approval

2. Transaction Monitoring & Reporting

Structuring Detection

Definition: Breaking large transactions into smaller amounts to avoid reporting thresholds

Example Scenario:

- Customer makes 5 transactions of LKR 1.9M within 2 hours

- Total value: LKR 9.5M (below CTR threshold)

- Required Action: File STR for suspected structuring

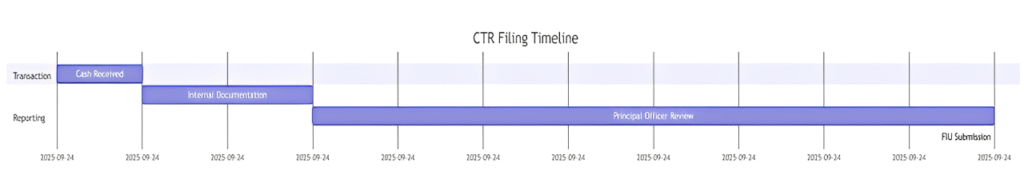

CTR Filing Timeline

3. Customer Identification at Cage

Document Verification Standards

- Sri Lankan NICs: Check hologram, UV features, chip data

- Foreign Passports: Verify MRZ, biographical page, visa validity

- Additional Verification: Cross-check with watchlists in real-time

High-Risk Customer Protocol

- Identification: PEP, high-risk jurisdiction, cash-intensive business

- Escalation: Immediate notification to Principal Officer

- Documentation: Complete EDD package before transaction processing

- Monitoring: Enhanced surveillance during visit

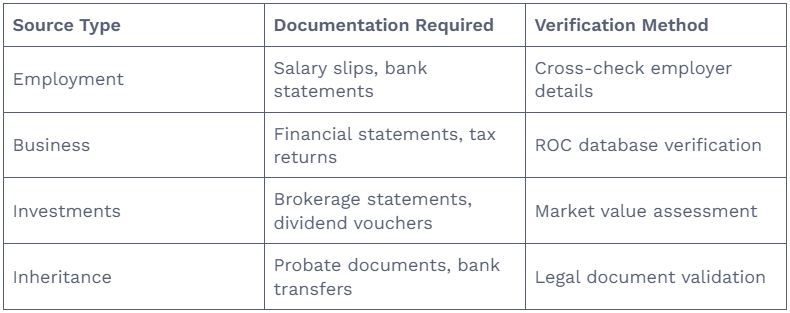

4. Source of Funds Verification

Acceptable Documentation

5. Currency Control Measures

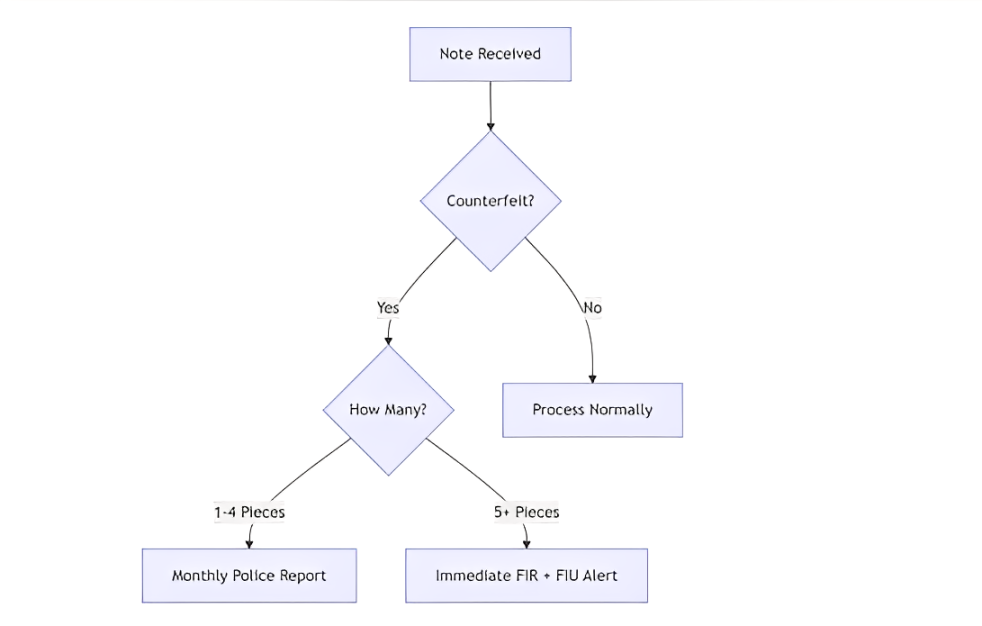

Counterfeit Detection Protocol

Cash Handling Security

- Regular cash counts with surveillance present

- Secure transportation for bank deposits

- Limitation on cash kept in cage overnight

- Random audits by internal control team

Leave a Reply