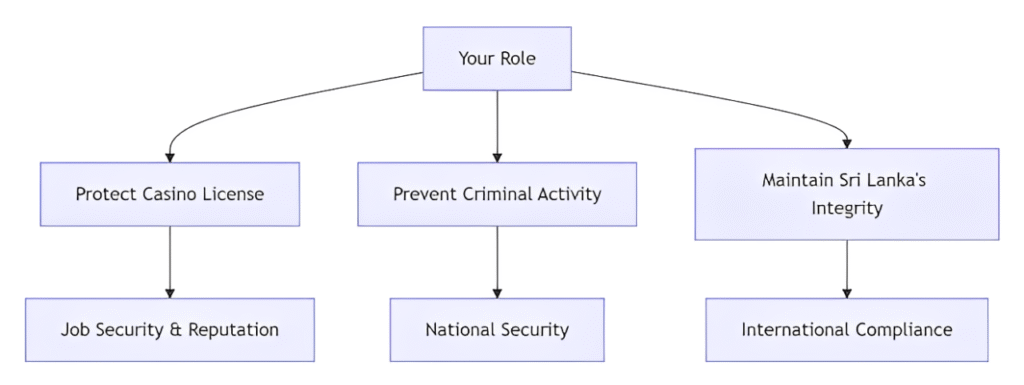

1. Introduction to AML/CFT Compliance

Why AML/CFT Matters to Every Employee

Key Message

Every employee, regardless of department, is a frontline defender against financial crime. Your vigilance protects our business, our customers, our country and the world.

Three Stages of Money Laundering

- Placement: Introducing illegal funds into the financial system

- Layering: Complex transactions to disguise the origin

- Integration: Laundered funds re-enter the economy as “clean” money

Casinos are vulnerable at all three stages, making every department critical.

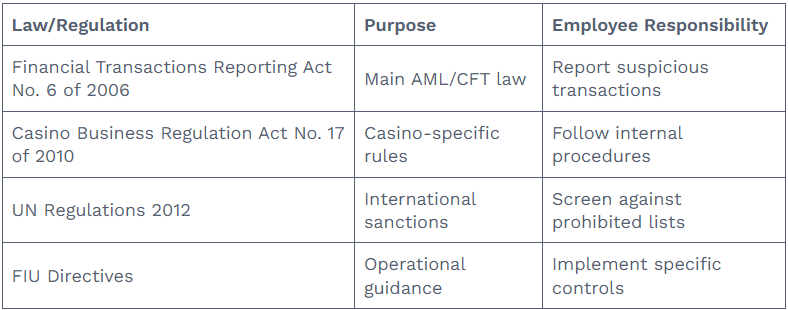

2. Sri Lankan Legal Framework

Key Legislation Overview

Regulatory Authorities

- FIU-Sri Lanka: Receives reports, provides intelligence

- CBSL: Oversight of financial system stability

- Police FCID: Investigation and enforcement

3. Key Terminology and Concepts

Essential AML/CFT Vocabulary

- KYC (Know Your Customer): Verification process for customer identity

- CDD (Customer Due Diligence): Basic identity verification

- EDD (Enhanced Due Diligence): Additional checks for high-risk customers

- PEP (Politically Exposed Person): Individuals with prominent public functions

- STR (Suspicious Transaction Report): Filed when suspicious activity detected

- CTR (Cash Transaction Report): Filed for cash transactions > LKR 10M

- Tipping-Off: Illegal disclosure of STR filing

4. Red Flag Indicators (Common to All Departments)

Behavioural Red Flags

- Customer appears nervous or avoids eye contact

- Reluctance to provide identification documents

- Inconsistent stories about source of funds or wealth

- Unusual knowledge of reporting thresholds

Transaction Red Flags

- Transactions just below LKR 1M or LKR 10M thresholds

- Rapid increase in transaction patterns without explanation

- Use of multiple accounts or identities

- Illogical transactions with no economic purpose

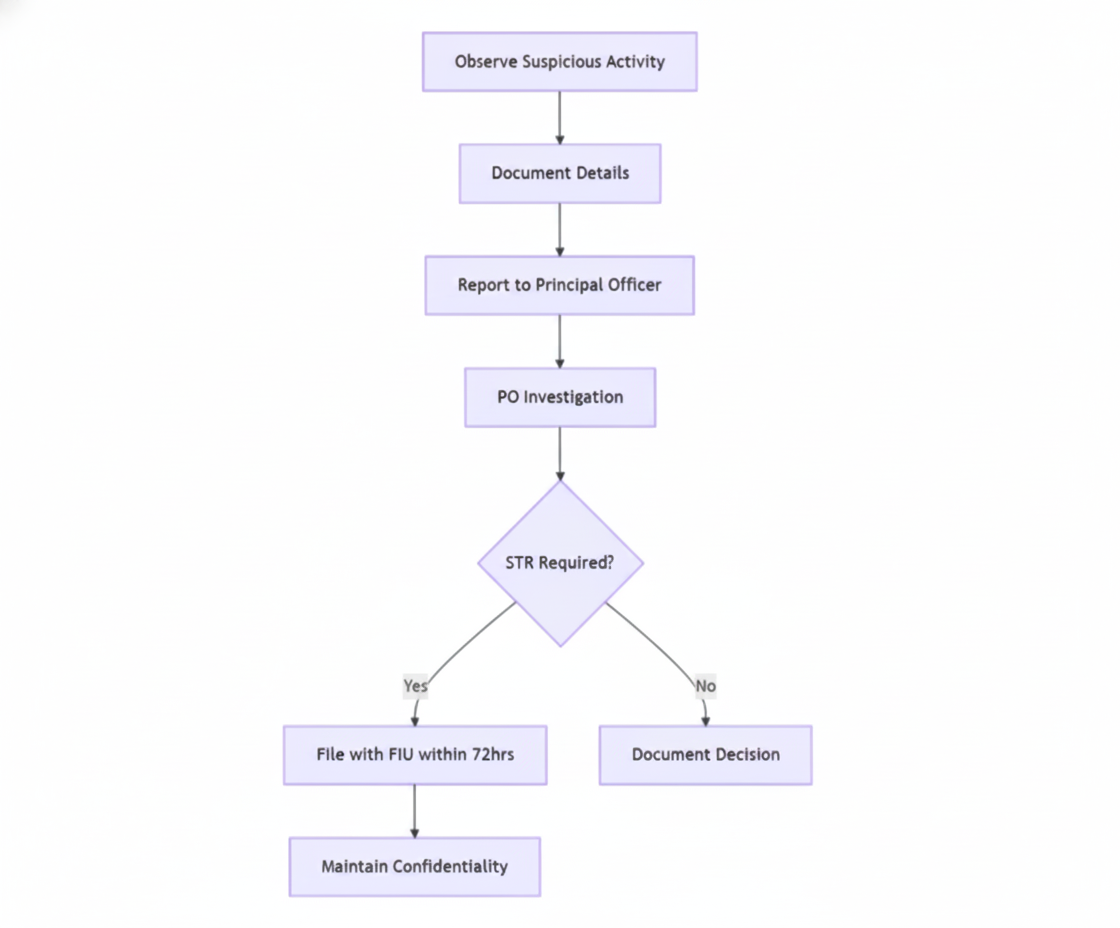

5. Reporting Obligations and Procedures

STR Reporting Workflow

Critical Rules for All Staff

- Never discuss suspicions with colleagues unnecessarily

- Never inform customers about STR filings

- Always document observations accurately

- Immediately report to your supervisor or Principal Officer

6. Consequences of Non-Compliance

Individual Consequences

- Disciplinary action up to termination

- Fines up to LKR 1 million

- Imprisonment up to 5 years for tipping-off

For More Reference

Please refer this before attending the questioner

Leave a Reply